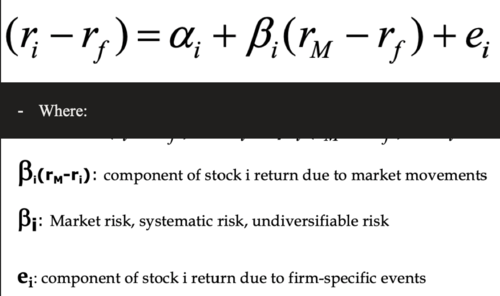

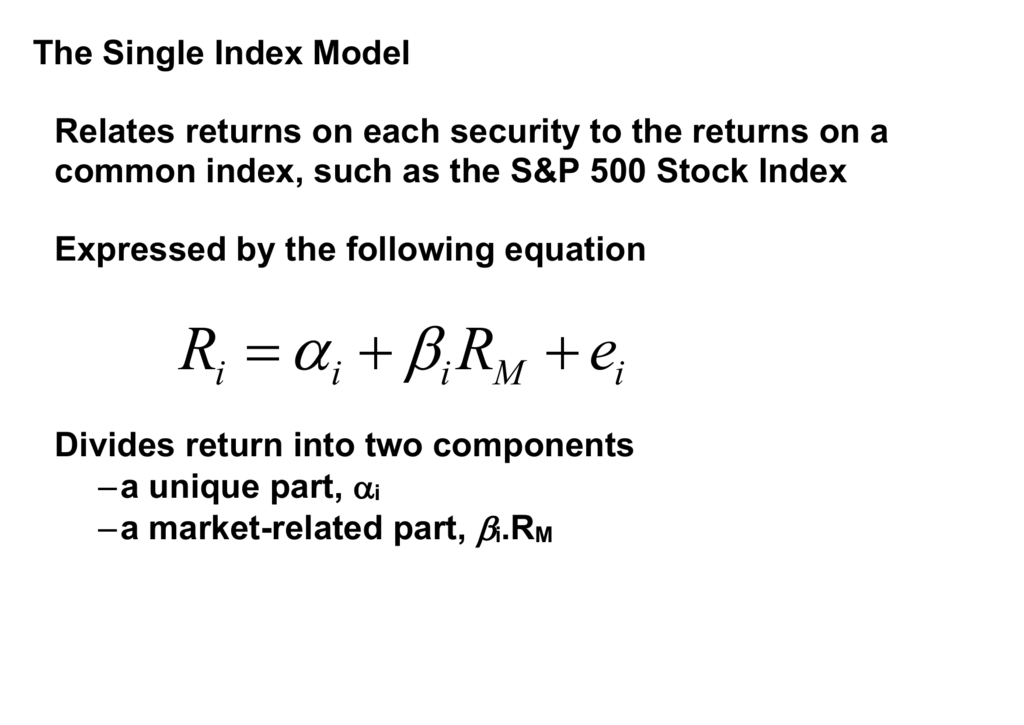

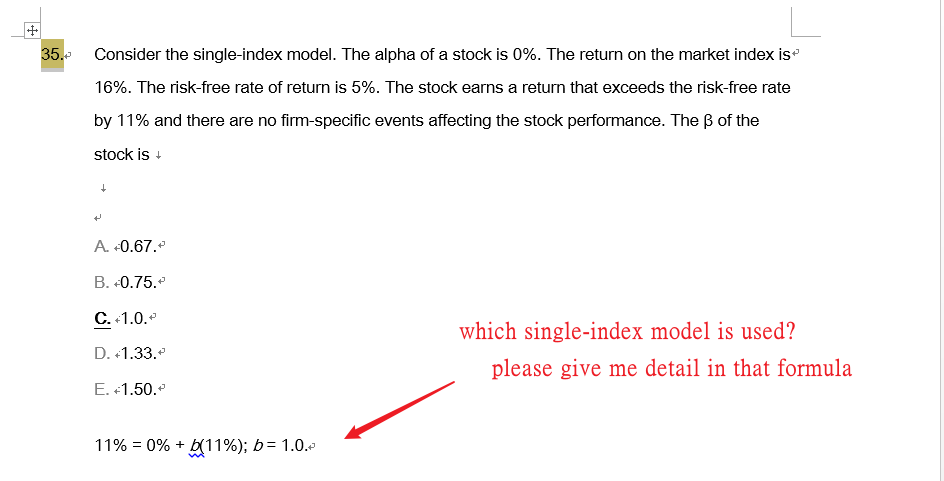

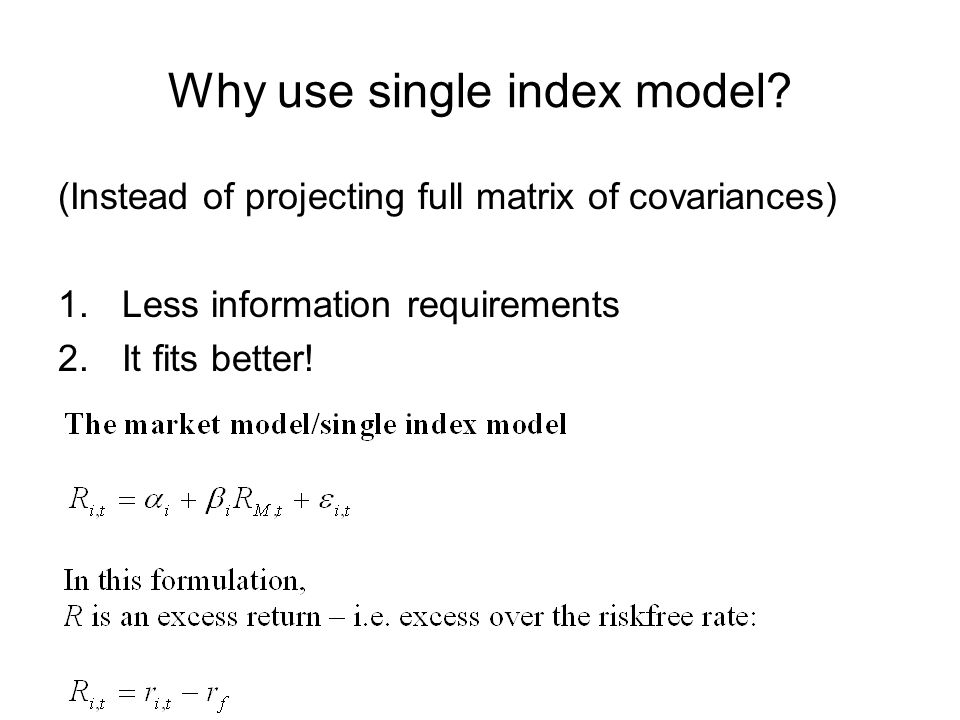

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

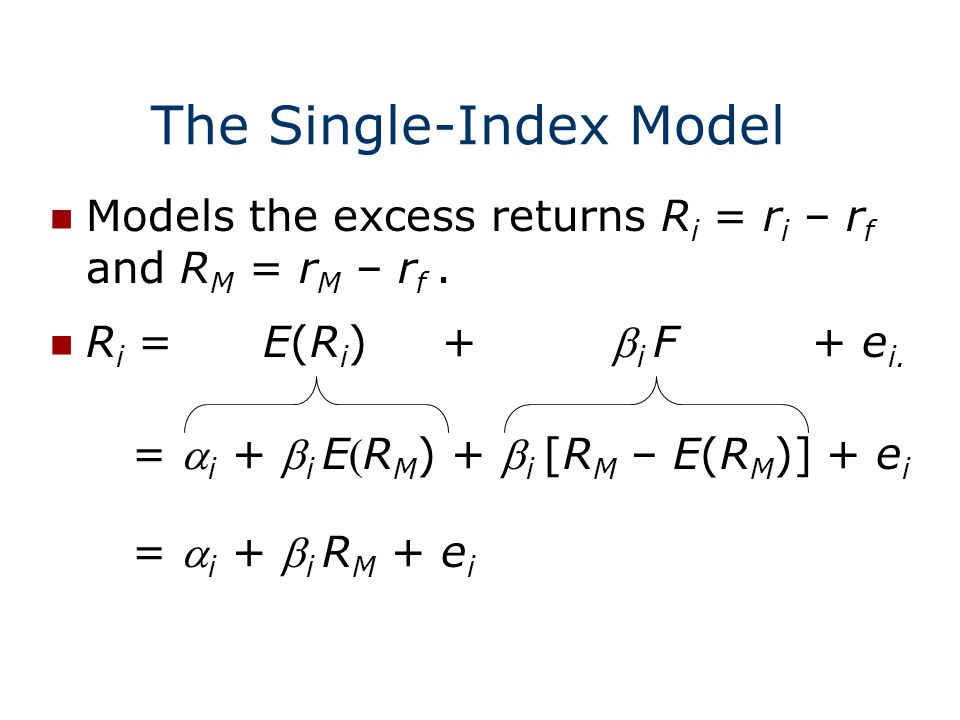

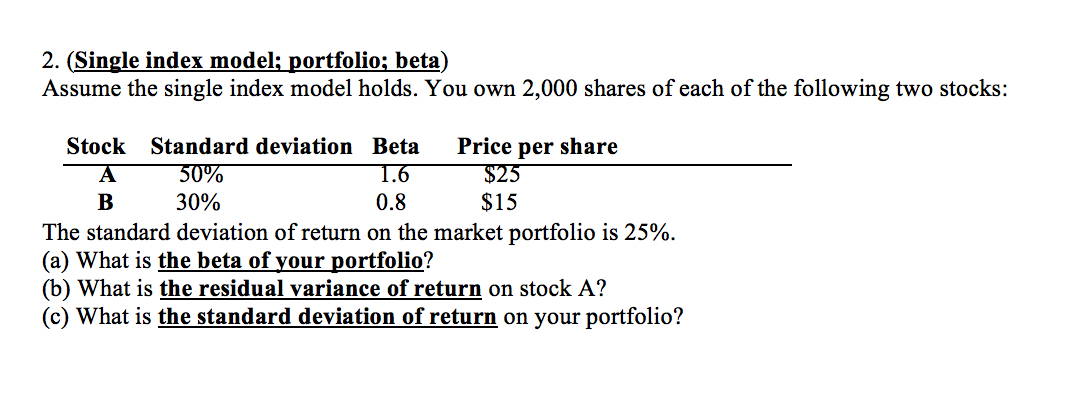

Why use single index model? (Instead of projecting full matrix of covariances) 1.Less information requirements 2.It fits better! - ppt download

![PDF] Single Index and Portfolio Models for Forecasting Value-at-Risk Thresholds * | Semantic Scholar PDF] Single Index and Portfolio Models for Forecasting Value-at-Risk Thresholds * | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/0add47406334e0019f2d147d33545fe12098358a/26-Table3-1.png)

PDF] Single Index and Portfolio Models for Forecasting Value-at-Risk Thresholds * | Semantic Scholar

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

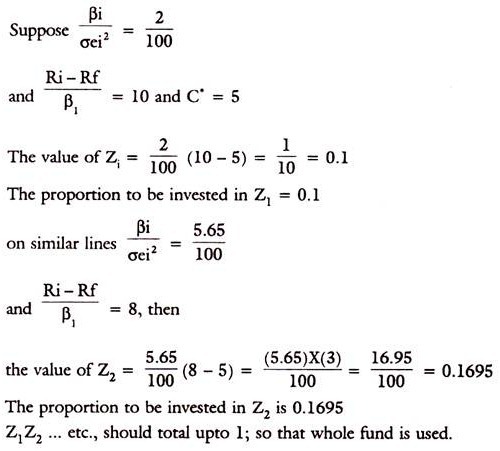

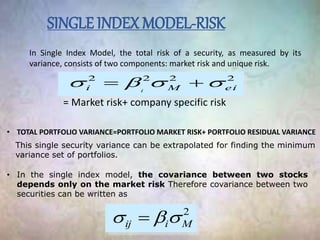

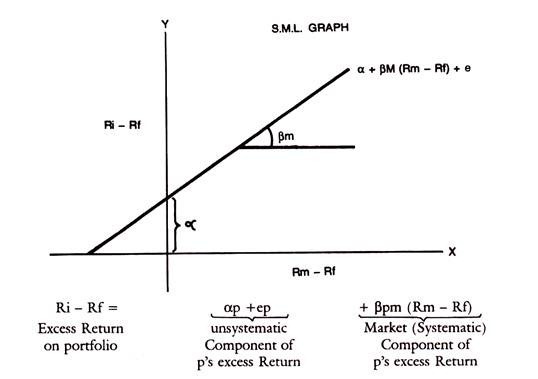

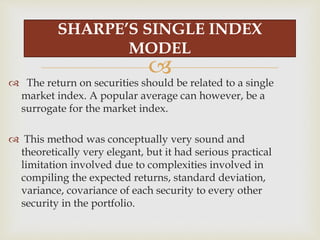

1 Single Index Model CAPM By Binam Ghimire. 2 Single Index Model “The mean variance approach” to portfolio analysis involves estimating the mean and. - ppt download

Single Index Model. Lokanandha Reddy Irala 2 Single Index Model MPT Revisited Take all the assets in the world Create as many portfolios possible. - ppt download